I don't want to make light of the situation, but looking from my perspective I have new insight into all of this. Have you though about where your kids would go in the event of your death? How will you provide for them from heaven? Do you have a life insurance policy? Are your assets going to have to go through probate court because they are not in a trust? And how do these questions alter and change when you have blended families? Obviously we needed an expert to guide us through and we feel pretty confident that we have made some wise decisions and of course the plan is that now the paperwork will sit for years and years and that we will both live until we are very old. But regardless it is comforting to begin chemo with a safety net..... A just in case.

Some of my regrets:

I can no longer apply for short term disability or long term disability because I would not pass the underwriting. I have cancer!! I used to have both of these as part of my district benefits but I decided to save money I would elect to let them lapse. Booo!! I just assumed I was young and that there would be time to add them at a later point. Bad move. Is this something you can do for yourself?

I do have a small life insurance policy and one supplemental plan offered through my employer, but it wouldn't provide much after a funeral and medical bills would be paid for. And now I regret not increasing my life insurance or applying for an additional one. At this point no changes can be made. Not once you have the cancer word in your medical chart. Have you provided a policy to take care of your family in case of your death?

One year I signed up for Conseco and it would pay you if you got cancer. (Like Aflac) But I was a single mom and money got tight and I let the policy lapse. That money would be so nice right now. I didn't really think I would ever get cancer.

There were many other issues we discussed with our estate planning, but the above things are just some regrets. I can't go back and make things better for the here and now. But you still have a chance to decide what you can do in your life to plan for these things. I was talking to a faculty member at my y not be able to school and we were talking about the push in the past few years for food storage. Now as things are changing in our country I am very grateful for my health insurance. I am happy to pay my deductibles and feel safe that my insurance company will cover their portion. I would be very nervous to be uninsured at this time. But perhaps in the future food storage isn't what I will need stocked up, but maybe I need some extra cash to pay medical bills.

Tonight I am grateful for the planning I do have in place, the planning we are implementing and yet it will still go to bed with some "what ifs" in my heart. Make plans. Be smart. You never know if and when cancer or something else will hit your household. Do everything you can to be prepared. You may not be able to jump in the deep end but do something!

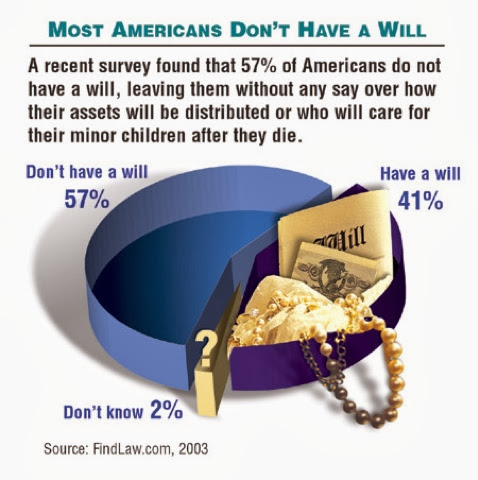

I am so sorry to hear about your cancer. My thoughts are with you. Anyway, talking about last will is a touchy subject, especially in front of your children, but sooner or later, it has to be done. I'm glad you did it as early as you could, and that your children responded positively.

ReplyDeleteDonte Duplessis @ FinancialBrokerageServices.com

While it’s never easy to be doing things such as writing wills, it ensures that our loved ones are cared for and protected. This is why it’s important that your wishes are clearly identified before they are recorded to avoid any problems. It’s really such a terrible thing to learn about your cancer. I know that you are loved nonetheless, and your family and friends know that you love them and that you are a very special person.

ReplyDeleteAnnette Fontana